We create custom-built backtesting software in languages like C++ and python for individual traders and institutions to test and optimize their strategies. We also offer general algorithmic trading consulting services.

Finding that backtesting doesn’t seem to work for you? This article may help you understand the statistical reasons for this.

We create backtesting software for all asset classes including backtesting strategies on equities, FX, options, futures and cryptocurrencies.

Whether you’re a lone day trader looking to test your strategy, or a sizable organisation looking for get your feet wet with algorithmic trading and machine learning, our cloud-based quant consulting service has got you covered. This includes:

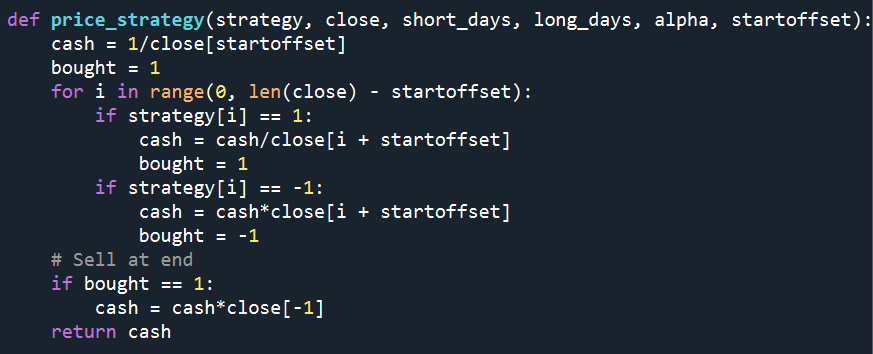

- Small-scale python scripts which backtest your strategy on historical data or synthetic data / hypothetical scenarios.

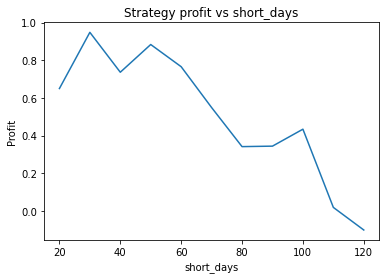

- Python scripts which can evaluate your strategy for different parameters and determine the parameters that give optimal profitability.

- Applications which use analyse large amounts of data, use machine learning techniques to find statistically significant signals, and find the optimal way to combine all meaningful signals into a single strategy.

- Software to automate your strategies by connecting directly to the exchange to grab the latest price information and post buy/sell orders.

There are many advantages of custom-built backtesting software over the simple built-in functionality offered by some exchanges:

- Code offers unfettered ability to do complex calculations on historical data, including analysing for the presence sophisticated technical analysis patterns.

- The software can analyse a wide variety of datasets when making trading decisions, including data from other assets and data from outside the exchange.

- The power of python – make use of python’s mathematical tools, machine learning and data analysis libraries

- The software can grow in scope and complexity as your business grows, as you expand into new strategies and products.

Partner with our experienced PhD quants to supercharge your trading business. Contact us today to discuss how we can design custom-built backtesting software to meet your needs.

To learn more about what’s involved in automating a strategy, see our simple guides for using python to connect to Interactive Brokers and Binance.

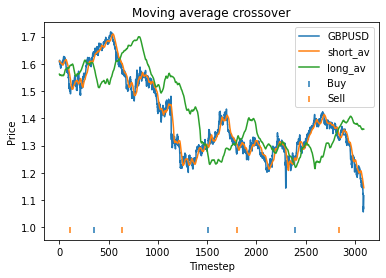

Check out our articles on backtesting moving average crossover strategies on Forex and on Bitcoin, and our article on cryptocurrency correlation strategies.

Learn more about our algorithmic trading consulting services. More generally, we offer a wide range of Quant consulting services for financial organisations of all sizes.