Looking for PhD quantitative support and risk management for your cryptocurrency business? Look no further! Contact us to learn how our quants can help.

As decentralized finance continues to grow in size, there is increasingly a need to quants (quantitative analysts) to bring to bear their skills from the world of traditional finance. Due to the relative immaturity of the industry, there is a huge opportunity for cryptocurrency startups to gain a competitive advantage through quantitative skills and tools.

Applications include derivative pricing models, risk modelling including market risk, credit risk and liquidity risk, and developing and backtesting trading algorithms. There are even many novel applications including the mathematics of decentralized oracles and so-called automated market makers.

We offer cloud-based PhD quant consulting and advisory services to the defi industry, all conveniently delivered remotely to anywhere in the world.

Decentralized finance needs a decentralized quant consulting service!

Derivative pricing models

The cryptocurrency derivatives market is still in its early stages. From TradFi, we already have the mathematical techniques to price options in the form of Black-Scholes. And we even have the tools to price exotic derivatives like American, Asian and barrier options. However, we do need sufficient liquidity in the options market in order to derive implied volatilities. We can develop robust libraries of derivative pricing models so your firm can price any kind of cryptocurrency derivative. See our main article on Cryptocurrency Derivatives.

Risk modelling for defi

With the crypto industry continuing to grow in size, risk management should play as important a role in managing customers and assets as it currently does in conventional finance. Given a number of high profile collapses in the industry, effective and reputable risk management could help to allay customer concerns about holding digital assets or interacting with your firm. It’s particularly useful to consider how the extensive existing literature on risk and risk modelling can be carried over to the crypto space. Market risk and liquidity risk modelling are standard challenges arising in other kinds of finance, and one can consult the literature in order to develop similar frameworks for the crypto space. We do however need to take due notice of the higher volatility which creates some additional challenges.

Market risk

There’s some uncertainty about whether digital assets should be modelled more like exchange rates or more like equities. But there’s not doubt that exchange rates between two digital currencies or between a digital currency and a conventional currency exhibit a high degree of volatility, raising some new challenges for market risk modelling

Borrowing and lending businesses have to take collateral to insure their loans. Similarly, exchanges need to take margin to ensure counterparties can meet their obligations when trades move against them. In both cases, firms are exposed to market risk on the value of the collateral, which could also be interpreted as FX risk between the relevant currencies where multiple cryptocurrencies are involved. In particular for borrowing and lending, one needs to be concerned about changes in relative value between collateral in one token and loaned amount in another. A mathematical model is needed which can can set parameters like the LTV (loan to value ratio) or liquidation trigger level in order to avoid the value of the collateral ever falling below the value of the loaned amount.

A standard way to model market risk is VaR (value at risk). We calculate the relative shift in each asset or market variable over each of the last 250 days, and apply each shift to today’s portfolio. We can then calculate the 99% worst quantile (typically assuming normally-distributed price moves) and make sure margin/LTV is sufficient. Actually, it may be advisable to work out what the liquidation window would be, and use that as our timeframe for VaR calculations. This may have implications for how much collateral you’re comfortable holding in any given coin.

Liquidity and execution risk

In addition to market risk, crypto firms are exposed to liquidity risk when trying to dispose of assets and collateral. The larger a firm grows and the larger its market share becomes, the more liquidity risk becomes a key concern. Liquidity risk may be of particular concern for emerging markets such as digital currencies.

Modelling liquidity risk involves looking not just at the mid price of the assets (as market risk tends to), but also considering the market depth and bid-ask spread. Both of these quantities can be examined in a VaR framework in a similar way to market risk. Large spreads are likely correlated to adverse price moves. Some research indicates they may not be normally distributed as is often assumed in market risk. Data analysis can be performed to determine the appropriate spread modelling assumptions for cryptocurrencies.

One can also consider modelling market risk and liquidity risk together in one model, looking at the 99% quantile of adverse price/spread/market depth moves and backtesting a portfolio or risk management protocols against the historical data or hypothetical scenarios.

Of relevance here also are liquidation algorithms / order splitting. While some illiquidity scenarios will be completely outside our control, in other scenarios the crisis arises only if we try to transact too much too quickly (which of course we may have good reason to attempt in a stressed scenario). Thus researching liquidation algorithms and backtesting them are important also.

In particular, it’s important to backtest against a stressed period in the market’s history, to understand how we would respond. This would include situations where collateral value declines dramatically or quickly, many customers wish to withdraw their collateral simultaneously, or periods of higher than usual volatility.

Another important tool is scenario analysis. This is where we consider a range of hypothetical qualitative and non-modellable scenarios, such as liquidity providers shutting down completely, to evaluate how we would respond.

Correlation and principal component analysis (PCA)

Since cryptocurrencies move together to a significant extent, we can separate market risk into systematic risk (i.e. FX rates between cryptocurrencies and USD, which could perhaps be taken as BTCUSD) vs idiosyncratic risk (cryptocurrencies moving independently of each other, ETHBTC for example).

If both the asset and the collateral are digital currencies (and not pegged to a conventional currency), then their price relationship is not affected by an overall move in the crypto space. Thus we would be interested in looking at the risk of relative movement only.

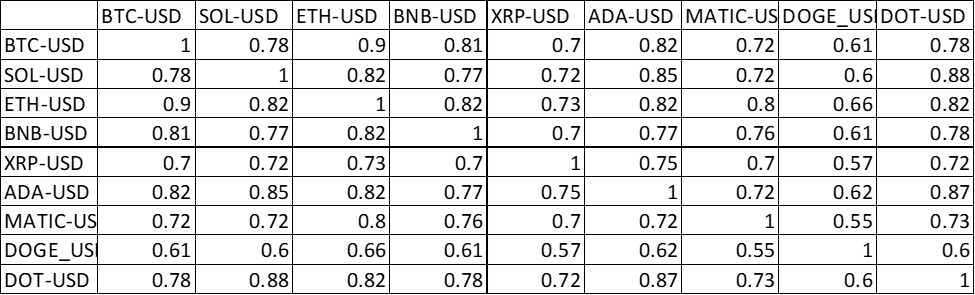

We can start with a correlation analysis of price moves over different time intervals of both traditional and digital currencies. Below shows the correlations of one day price moves over a one year period. It’s clear that there is significant correlation.

We can also do PCA (principal component analysis) to determine how the various coins relevant to the firm move together / contrary to each other. This helps us to understand what benefit is derived from diversification. A PCA analysis is often done on rates curves to determine to what extent short / long tenors move together.

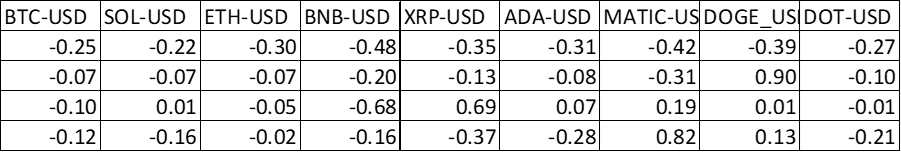

The below PCA analysis shows that 75% of the variance in the price shifts can be explained by all coins moving in the same direction (notice how in the first vector/row all values have the same sign). Interestingly, 9% of the variance can be explained by DOGE moving contrary to all the other coins (notice how it is the only one with a positive value in the second row). The next two rows, explaining 4.7% and 4.5% of the variance respectively, show the coins moving in different directions to each other.

[75%, 9%, 4.7%, 4.5%]

Backtesting and trading algorithms

We design software to backtest, optimize or automate trading or investing strategies.

Backtesting can be performed on historical data, or on hypothetical synthetic data to test the strategy against a wide range of possible market conditions. Usually, trading strategies have a range of possible parameters which we can set for optimal profitability by examining their behaviour on historical data. If you’re still placing your buy and sell orders manually, we can automate execution by writing code to interact directly with the exchange. This not only allows faster reaction, it also allows sophisticated data analysis and machine learning to be incorporated into your strategy. And automation is particularly important for crypto markets which still operate even while you sleep.

The benefits of backtesting actually extends beyond trading. Almost any business or risk strategy can be backtested against historical or hypothetical data in order to test the profitability or robustness of the business.

For more details, see for example our article on statistical arbitrage / pairs trading for crypto, and backtesting a moving average crossover strategy on bitcoin. More generally, we offer algorithmic trading consulting services on both traditional and digital asset classes.

Decentralized oracles

How does an decentralized oracle convert multiple data sources into a single price or datum? For example, some data sources (for example, different exchanges) may receive different weighting, and more recent data points may be weighted differently than older ones. The oracle might also trim the data between two quantiles to remove the influence of outliers. Some decentralized oracles offer a reward for participants that submit data close to the final price, such as Flare Time Series Oracle (FTSO). How would you go about succeeding as such a participant, or just predicting the final price for your own use? This is where machine learning algorithms come in.

We can build predictive algorithms for decentralized oracles, using machine learning, which predict how oracles combine a large number of inputs into a final output.

Automated Market Makers

Automated market makers, or AMMs, provide liquidity to the market by allowing exchange between two or more cryptocurrencies. They do this by incentivizing people to contribute coins to the pool, and by penalizing the exchange rate if the liquidity ratio swings too far in the direction of one of the coins.

The mathematics around profit and risk of automated market makers and the liquidity tokens they issue require some careful thought. We can conduct this analysis and conduct backtesting of your business strategy.

For details on the Uniswap algorithm, see this article on the CURVE exchange.