PhD Quantitative Analysis, Financial Modelling and Financial Math Consulting and Advisory Services for Finance Professionals.

Quant Developer Consulting including custom developed financial algorithms in C++/python/VBA for pricing, trading, investing, insuring and financial risk.

We provide quantitative solutions for financial services firms of all kinds including banks, hedge funds and trading firms.

Our quantitative consulting and advisory services include:

- Development of financial risk models including operational, credit, market risk models and FRTB compliance.

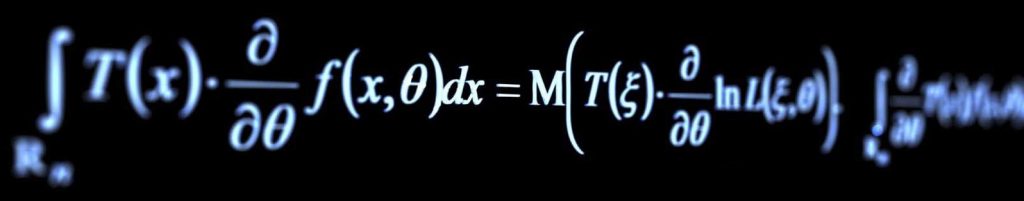

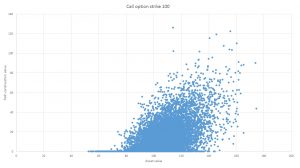

- Development of derivative pricing models including Black-Scholes, Monte Carlo, finite difference and Longstaff-Schwartz

- Monte Carlo risk models and dependency modelling tools such as copulas

- Designing mathematical algorithms for trading or investing in languages like C++, Python and VBA. See Algorithmic Trading Consulting Services.

- Model validation of risk and pricing models, including sensitivity and stress testing

- Code maintenance and debugging

- Financial developer and quant developer consulting services including pricing software, risk software and trading software.

- Financial applications of data science and machine learning, including doing financial computations on Nvidia GPUs.

- All kinds of financial mathematics consulting including PhD-level mathematical research projects (see mathematics consulting)

Would you like to design Monte-Carlo risk models which complete in 15 minutes instead of taking all day?

Have you ever wondered why heavy tailed risk models dramatically overstate the median loss?

Learn how to convert volatility surfaces from moneyness to delta

Mathematical modelling is everywhere in the financial services industry, but the expertise to do it in a meaningful way is thin on the ground. We speak from personal experience when we say that at many banks the quality of the risk modelling can be very low. We’ve repeatedly been able to find very material errors that had been overlooked by internal validators, external validators and the regulator! In fact, we’ve seen expensive risk modelling work from one of the big four financial consulting firms where, had they simply taken a guess at what the VAR would be, it would have been more useful. Simple models are just as likely to be erroneous as sophisticated ones. And business managers are left frustrated, unable to understand why the regulators are never satisfied.

On the other hand, we’ve found that trading firms are often interested in exploring how they could benefit from quantitative research like algorithm optimization and machine learning, but lack the expertise to get started – even at some very large organisations. This is where cloud-based quant consulting can add a lot of value to firms both small and large.

Keeping in mind the poor quality of much of the quantitative work in the finance industry, I believe there is considerable scope for firms to gain a competitive advantage from quant consulting services. We also offer sophisticated mathematical research services around things like data science and machine learning.

To register your interest, simply contact us.